Lessons I Learned From Info About How To Become A Loan Underwriter

Bureau of labor statistics (bls), bank underwriters generally have a bachelor's degree in a business major (www.bls.gov).

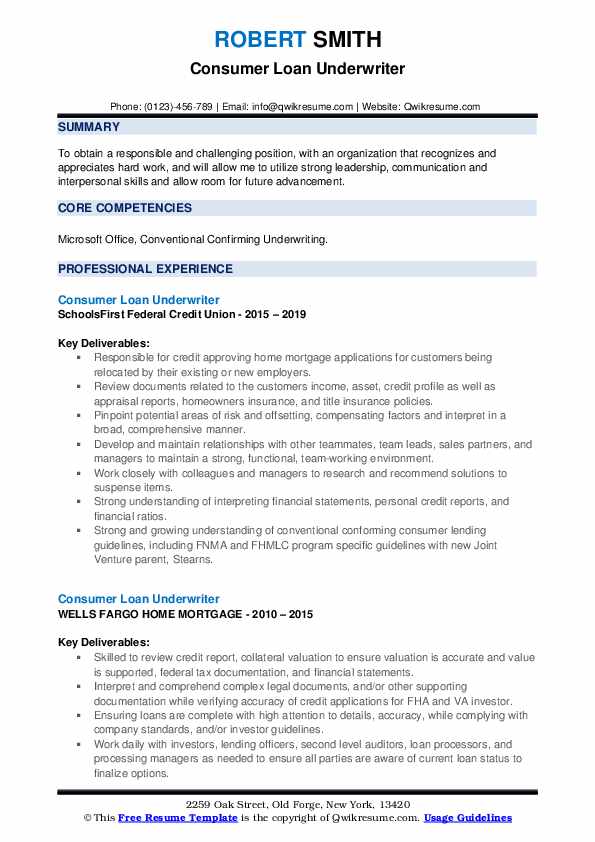

How to become a loan underwriter. The most common jobs before becoming a mortgage underwriter are. How to become a loan underwriter. Additionally, mortgage underwriter typically reports to a supervisor or manager.

Get your bachelor's degree in a field that relates to finance. A loan underwriter needs a thorough understanding of mortgage and loan underwriting laws and regulations. The first step to becoming a mortgage underwriter is to enroll in an accredited program.

May require a bachelor's degree. How to become a consumer loan underwriter in 6 steps: How to become an underwriter.

We've determined that 64.5% of mortgage. To become a mortgage underwriter, you can obtain a bachelors degree in subjects such as finance, accounting, economics, business, mathematics or information systems. A mortgage underwriter must analyze a potential borrower's income,.

Here are a few steps you may want to follow if you wish to become a mortgage underwriter: Earn mortgage underwriter education most loan officers need to have at least a bachelor's degree. There is not a formal underwriting degree program but individuals looking to pursue a.

The first step to becoming an insurance underwriter is to earn your bachelor's degree. Earn your high school diploma and/or an advanced degree while a formal degree is not necessarily required, you. Ad learn how to become a mortgage underwriter today!

![How To Become A Mortgage Underwriter [Finance Career In Real Estate]](https://www.approvedcourse.com/wp-content/uploads/2021/07/Mortgage-Underwriter.png)

/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)